Imagine trying to buy a rare collectible in a quiet, out-of-the-way market versus a bustling market. In the latter, transactions are swift and prices stabilize quickly, while in the former, finding a buyer or seller can be challenging and the price can swing wildly. In the financial world, liquidity plays a similar role. It’s the ease with which you can buy or sell an asset without significantly affecting its price. In this article, we’ll explore the concept of liquidity in depth, discuss its critical impact on your trading strategy, and offer practical tips to help you navigate markets with confidence.

Defining Liquidity and Its Importance

Liquidity refers to how quickly and efficiently an asset can be converted to cash without causing a significant impact on its market price. High liquidity means abundant buyers and sellers, leading to narrow bid-ask spreads and smooth execution of trades. In contrast, low liquidity can result in wider spreads, slippage, and even price manipulation. Understanding liquidity is essential because it influences everything from the timing of your trades to the risk of executing large orders.

The Mechanics Behind Liquidity

To fully grasp liquidity, consider these key components:

Bid-Ask Spread:

The bid price is what buyers are willing to pay, and the ask price is what sellers demand. In highly liquid markets, this spread is minimal, allowing for efficient transactions. When the spread widens, it signals lower liquidity and potentially higher transaction costs.

Order Book and Market Depth:

The order book displays all the buy and sell orders for an asset at various price levels. Market depth indicates the volume of orders at each level. A deep order book suggests strong liquidity, meaning large trades can be executed without significant price changes.

Market Makers:

These are institutions or individuals who continuously provide buy and sell quotes. Their presence ensures that there’s always someone on the other side of your trade, thus maintaining liquidity even during volatile periods.

Impact of Liquidity on Trading Performance

Liquidity influences several key aspects of trading:

Execution Speed:

In highly liquid markets, trades are filled almost instantly, which is crucial for strategies that rely on quick entries and exits. For day traders and high-frequency traders, every millisecond counts.

Price Stability:

High liquidity tends to stabilize prices during normal market conditions, reducing the chance of dramatic price swings caused by a single large order.

Risk of Slippage:

Slippage occurs when the execution price differs from the expected price, often due to a lack of liquidity. This risk is particularly pronounced in markets with low trading volume or during periods of extreme volatility.

Adapting Your Strategy to Liquidity Conditions

Different liquidity environments call for different approaches:

In High-Liquidity Markets:

Large institutional investors and day traders thrive here. Scalping strategies, where traders profit from small price changes, are especially effective. The minimal bid-ask spread allows for quick execution and low transaction costs.

In Low-Liquidity Markets:

When trading in less liquid environments, it’s wise to use limit orders to control the price at which you enter or exit a position. Reducing order size and avoiding trades during off-peak hours can also mitigate the risks associated with slippage and volatile price moves.

Utilizing Liquidity Indicators:

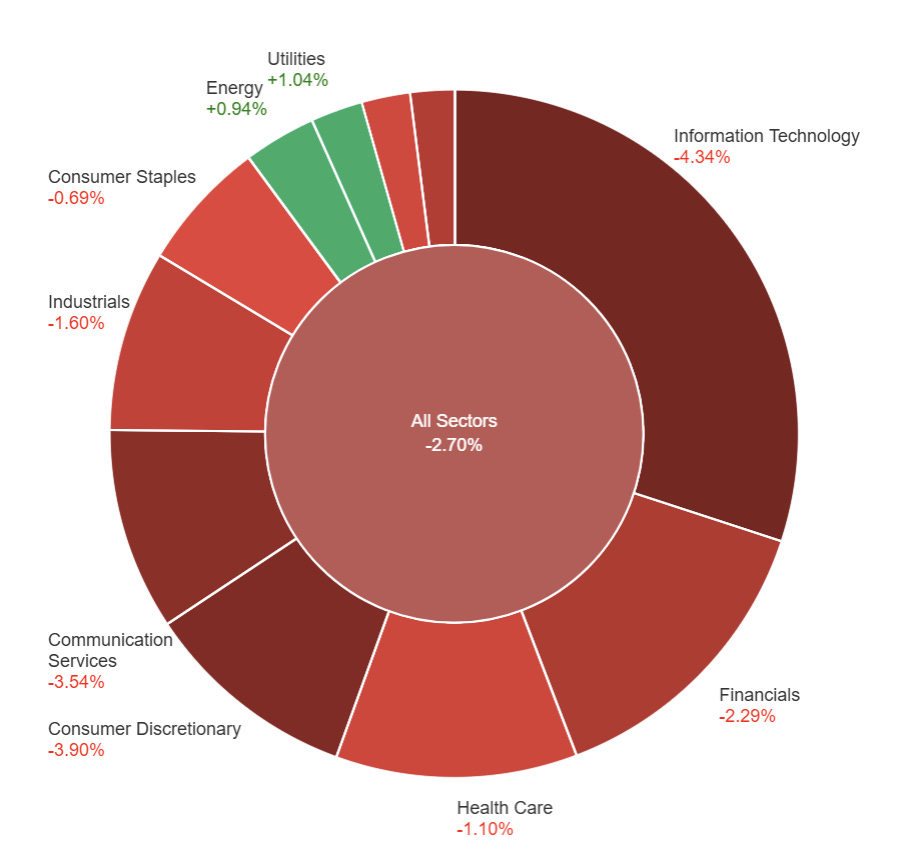

Many trading platforms now offer real-time liquidity indicators and heat maps that show the distribution of orders. Learning to interpret these tools can give you a significant edge in timing your trades and avoiding liquidity traps.

Consider the case of a trader attempting to buy a large volume of a thinly traded stock. In a low-liquidity environment, their substantial order may push the price higher than anticipated, resulting in a less favorable entry point. Conversely, a trader operating in a highly liquid market can execute large orders smoothly, ensuring that the price remains stable. Such scenarios underscore the importance of tailoring your strategy to the liquidity conditions of the asset you’re trading.

Integrating Liquidity into Your Trading Plan

Monitoring Tools:

Use advanced charting software and order book data to monitor liquidity levels. Tools like volume profile indicators can provide insight into where large orders are concentrated, offering clues about future price movements.

Risk Management:

Always factor liquidity into your risk management strategy. Ensure that your stop-loss orders and position sizes are adjusted to account for potential slippage in low-liquidity markets.

Stay Informed:

Economic events, earnings reports, and geopolitical developments can rapidly alter liquidity conditions. Keeping abreast of such news will allow you to anticipate and adapt to sudden shifts in market dynamics.

While technical tools and strategies are essential, understanding liquidity also means recognizing its human element. Markets are driven by investors, traders, and institutions each with their own motivations and reactions. By paying attention to market sentiment and the flow of information, you can better anticipate how liquidity might change throughout the trading day. A trading journal that captures not only your trades but also your observations about market mood can be an invaluable resource.

Liquidity is more than just a technical metric; it’s the lifeblood of the market that affects every trade you make. By understanding the mechanics behind liquidity, adapting your strategies to different market environments, and incorporating a mindful approach to risk, you can enhance your trading performance significantly. Whether you’re a seasoned trader or a beginner, mastering liquidity is a critical step toward more informed, confident trading.

*Disclaimer: Not Financial Advice. Investors should conduct thorough research and seek professional advice before making any investment decisions.