Navigating the Stock Market Amidst Interest Rate Uncertainty

For many investors, the recent shifts in interest rates by the Federal Reserve have stirred up some concerns.

The Fed's decision not to lower interest rates has caused some ripples in the stock market, leading to a bit of a slowdown in what had been a robust rally.

So, what exactly does this mean for investors, especially those who are just starting out?

Understanding the Situation

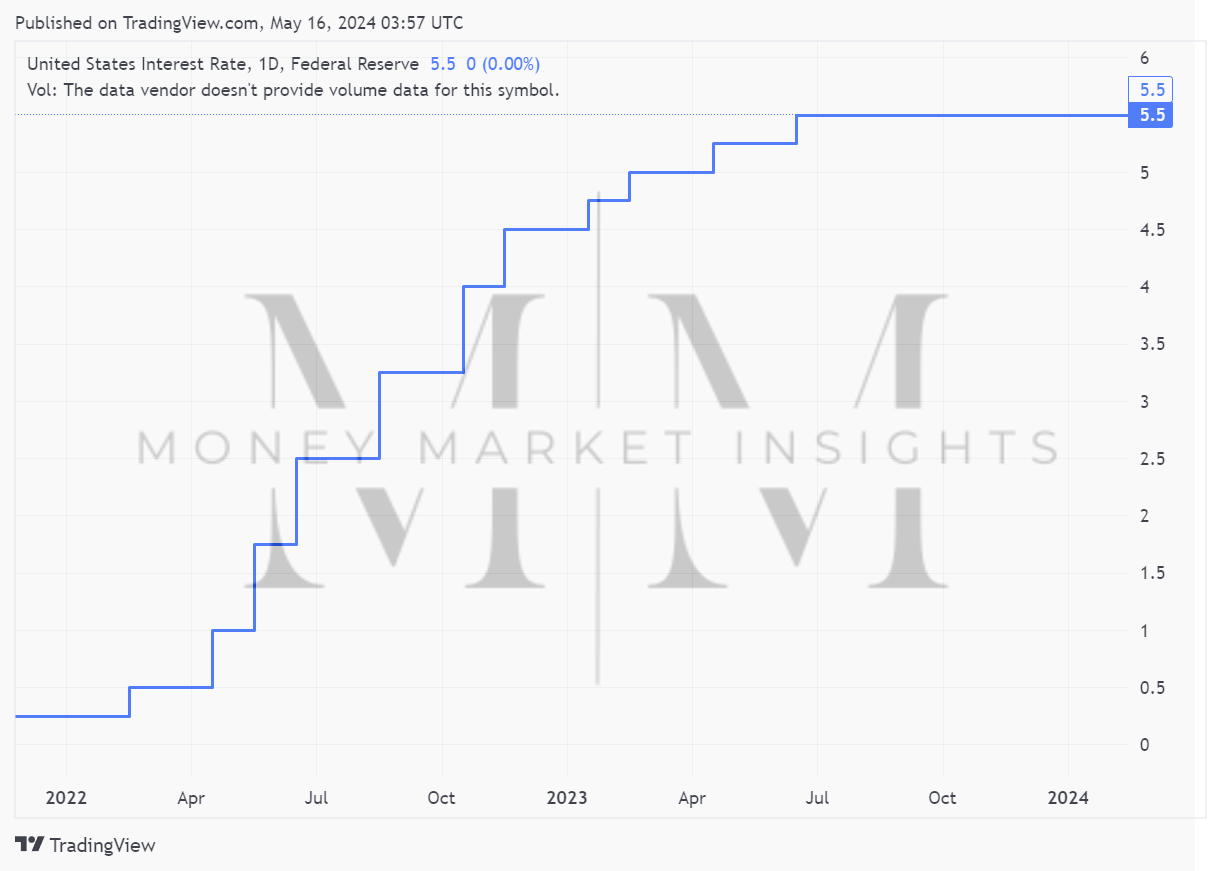

The Federal Reserve, often referred to simply as "the Fed," plays a crucial role in managing the economy of the United States. One of its tools for doing this is adjusting interest rates. When the economy needs a boost, the Fed might lower interest rates to encourage borrowing and spending. Conversely, when inflation becomes a concern, the Fed may raise interest rates to cool down spending and keep prices stable.

Recently, the Fed has indicated that it's unlikely to lower interest rates anytime soon. This decision has caused some worry among investors, as higher interest rates can mean higher borrowing costs for consumers and potentially lower profits for companies. As a result, the stock market has seen a bit of a slowdown.

Putting Things in Perspective

Despite these concerns, history tells us that higher interest rates don't always spell doom for the stock market. In fact, during periods when the Fed has paused its rate adjustments, the stock market has performed quite well on average.

For example, data compiled over several decades shows that the S&P 500 index, a broad measure of the stock market, has typically seen gains during these pause periods. Even during the current pause, which began after the Fed last raised rates in July 2023, the stock market has continued to climb.

What's Driving the Fed's Decision?

The Fed's decisions are influenced by a variety of factors, including economic indicators like job growth and inflation. Despite concerns about inflation, the US economy has shown resilience, with strong job growth and consumer spending.

However, recent data, such as the April jobs report, has shown signs of a cooling labor market. Job growth slowed, and first-time applications for unemployment benefits rose, indicating a potential slowdown in hiring. Additionally, wage growth, a key factor in inflation, has slowed down.

What Investors Can Do?

It's essential to remember that investing is a long-term endeavor. While short-term fluctuations may cause some uncertainty, staying focused on your long-term goals is crucial.

Diversification is also key. By spreading your investments across different assets, such as stocks, bonds, and real estate, you can help mitigate risk and protect your portfolio from market volatility.

Additionally, staying informed about economic trends and the factors influencing the market can help you make more informed investment decisions.

Looking Ahead

While the Fed's decision to hold off on lowering interest rates may have caused some short-term turbulence in the stock market, it's important to keep things in perspective. Historically, the market has weathered similar situations, and there's no reason to believe that this time will be any different.

By staying focused on your long-term investment goals, diversifying your portfolio, and staying informed about economic trends, you can navigate the stock market with confidence, even amidst uncertainty about interest rates.

*Disclaimer: Not Financial Advice. Investors should conduct thorough research and seek professional advice before making any investment decisions.