Imagine being able to grow your portfolio by making precise bets on market moves without owning the stock. Sounds powerful, right? That’s the world of options trading—a tool that can seem complicated but offers incredible opportunities for growth and protection when mastered.

What Are Options?

At its core, an option is a contract. It gives you the right (but not the obligation) to buy or sell a stock at a specific price before a set date. Think of it as placing a reservation on a stock without committing fully to it.

Two types of options exist:

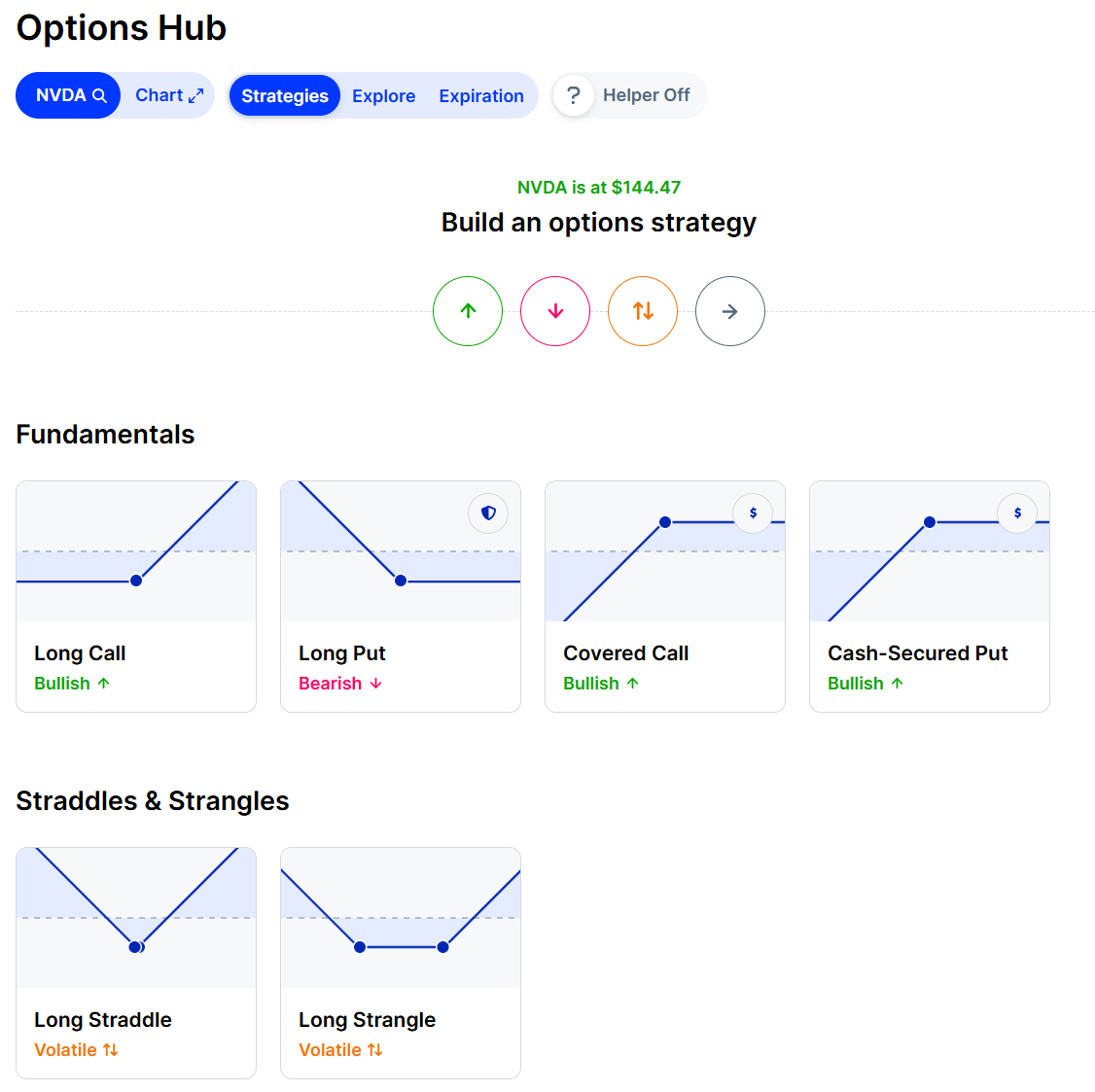

Call Options: These give you the right to buy a stock at a certain price. Think of it as a bet that the stock will go up.

Put Options: These allow you to sell a stock at a certain price. Essentially, you’re betting the stock will go down.

Why Trade Options?

Options can help you:

Enhance Returns: Small investments in options can lead to big profits when the market moves in your favor.

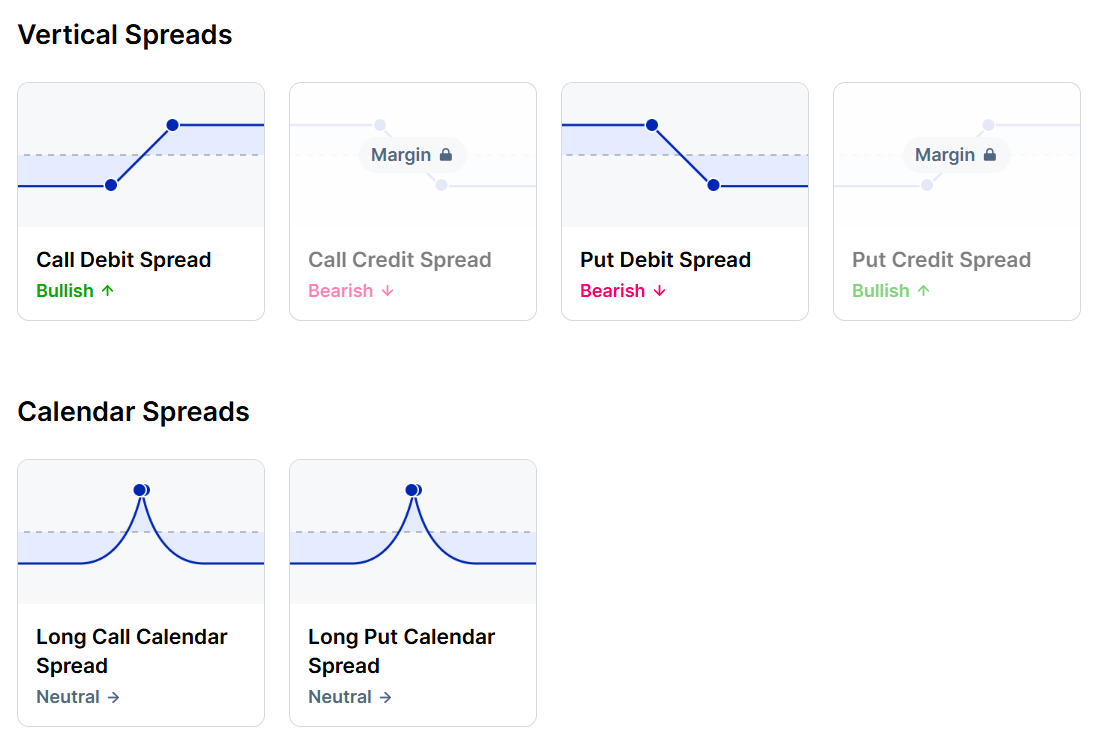

Limit Risk: You can cap your losses while leaving room for gains.

Hedge Your Portfolio: Protect your investments from major downturns by strategically using puts.

An Everyday Example:

Imagine you want to buy a new house. Instead of buying the house outright, you pay a small fee to reserve it for six months at today’s price. If the housing market skyrockets, you lock in a bargain. If it crashes, you walk away, losing only your reservation fee. That’s how options work.

Key Terminology to Know:

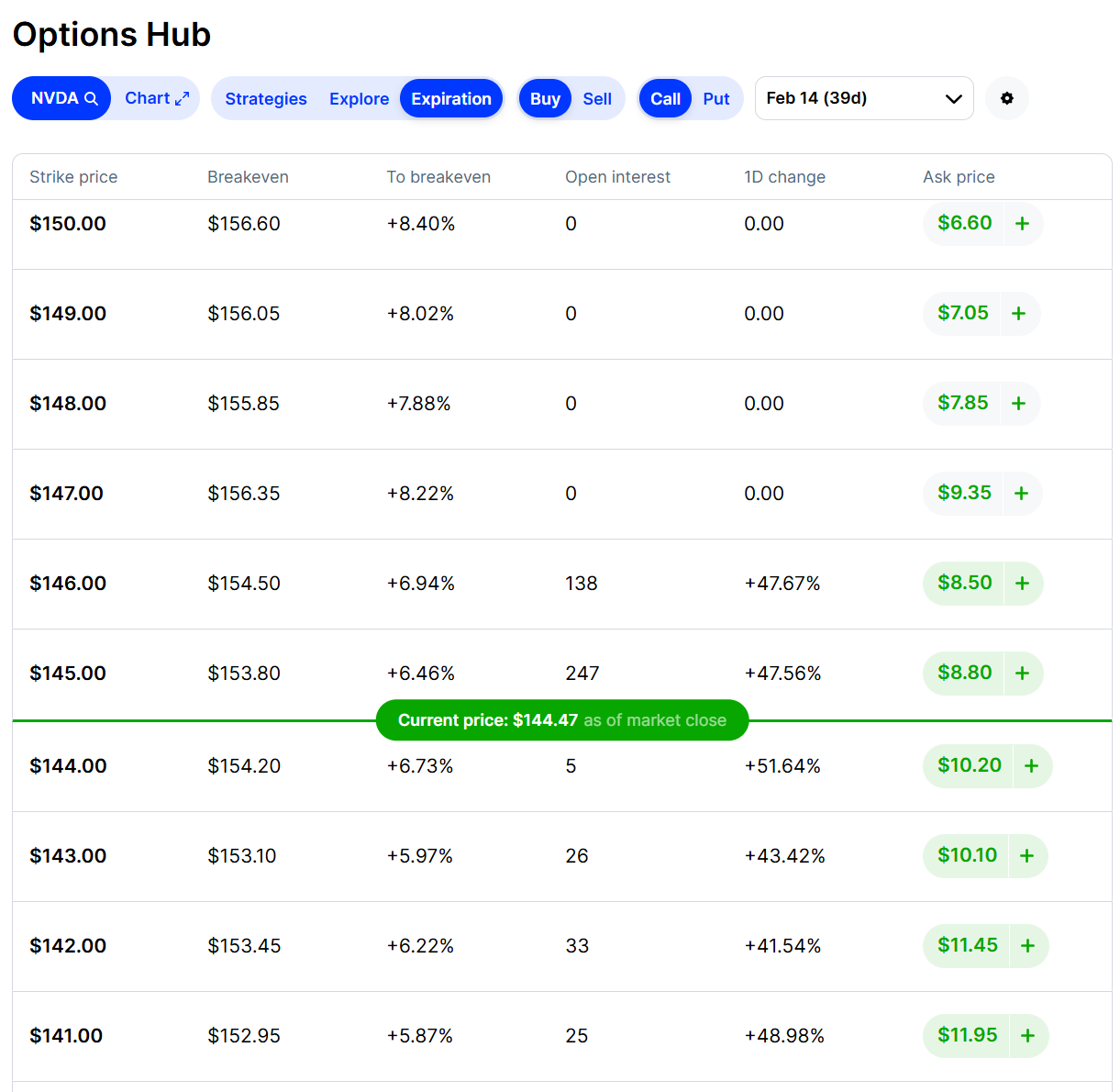

Strike Price: The price at which you can buy or sell the stock.

Expiration Date: The deadline for exercising the option.

Premium: The price you pay for the option.

A Simple Strategy for Beginners:

Try the Covered Call strategy:

Own shares of a stock.

Sell a call option on those shares to generate income. If the stock price doesn’t rise above the strike price, you keep the premium as profit. If it does, you sell the stock at the agreed-upon price, likely for a profit.

Options trading might sound intimidating, but with small steps, you can learn to use this tool to grow and protect your portfolio. Start with a paper trading account to practice without risking real money. And remember, every expert trader was once a beginner!

*Disclaimer: Not Financial Advice. Investors should conduct thorough research and seek professional advice before making any investment decisions.