The AI Revolution: NVIDIA's Rise and the Investment Phases of Transformative Technology

In recent years, artificial intelligence (AI) has transitioned from a futuristic concept to a tangible innovation poised to significantly impact the next half-century.

While the internet will likely remain one of the most critical advancements of our time, AI is emerging as a game changer. Similar to the early days of the internet, the journey to fully mature AI technology and identify its best use cases will be longer and more complex than many investors currently anticipate.

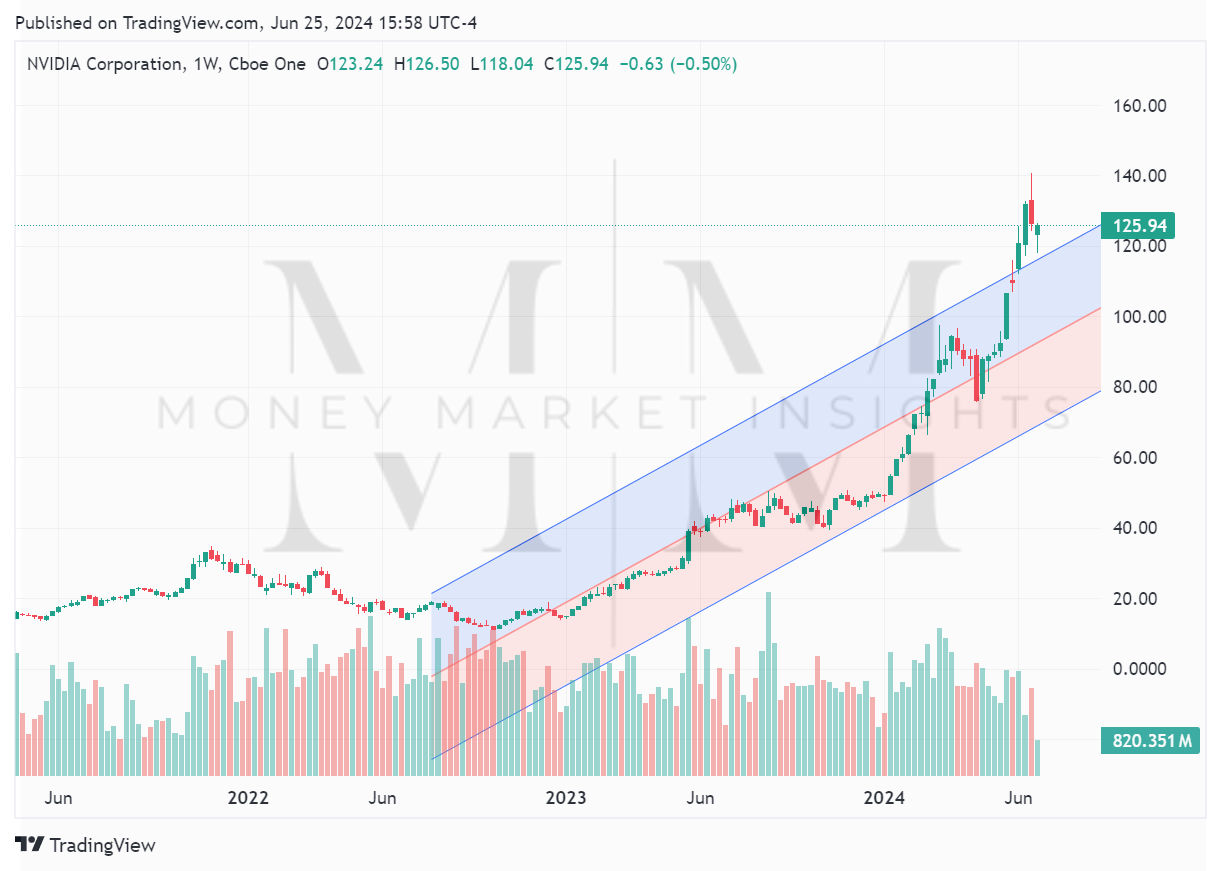

NVIDIA's Rapid Ascent

NVIDIA NVDA 0.00%↑ has positioned itself as a central player in the AI revolution, becoming the preferred choice for AI computing. The company's market capitalization has skyrocketed in just two years, placing it among the world's most valuable companies, alongside tech giants like Microsoft MSFT 0.00%↑ and Apple AAPL 0.00%↑. Initially, NVIDIA added a trillion dollars in market cap over several months, but the latest trillion was achieved in just a matter of weeks.

This remarkable growth mirrors the early internet era when companies like Sun Microsystems and Cisco Systems CSCO 0.00%↑ experienced explosive increases in value as they provided essential infrastructure for the burgeoning internet. Today, NVIDIA is seen as providing the "technological plumbing" for AI, attracting substantial investment from those eager to capitalize on the next big technological leap.

The Phases of Transformative Technology

The evolution of AI and its market impact closely parallels past technological revolutions, including the internet. These transformations typically follow a predictable investment cycle, which can be broken down into four distinct phases:

Phase 1: The Early Investors

In the first phase, visionary investors recognize the potential of a new technology and invest in companies poised to benefit. These investors understand that their investment thesis might take years or even a decade to materialize. They remain committed, not swayed by short-term price fluctuations, and hold their investments until their predictions are either validated or proven wrong.

Phase 2: Sophisticated Investors Join In

As the technology progresses, sophisticated investors who see imminent potential begin to invest. During this phase, the technology has developed significantly but is not yet widely adopted. This period is marked by substantial volatility due to delays, unforeseen challenges, and higher costs. Issues such as supply chain constraints, regulatory hurdles, and inadequate infrastructure often slow progress. However, these challenges can usually be overcome with time and significant investment.

Phase 3: Mass Recognition and Adoption

The third phase occurs when the public widely recognizes the importance of the new technology. This accelerates development and adoption, attracting a large influx of retail investors. Companies associated with the technology see their market caps soar, creating a period of explosive share price growth. This phase is ideal for trend-following investors looking to capitalize on multiple years of rapid growth.

Phase 4: Maturation and Market Adjustment

In the final phase, the technology transitions from limited adoption to widespread use, and companies begin to build profitable business models around it. This phase often brings turbulence for the leading companies as new competition emerges and growth slows. Early in Phase 4, high-flying stocks can suffer dramatic declines as investors adjust their expectations. This phase can last many years or even decades, with continued innovation and new successful companies emerging.

AI: Following the Script

AI appears to be following this well-trodden path of technological innovation. We might be nearing the end of Phase 3, with companies like NVIDIA experiencing explosive growth. However, as history shows, investors will eventually temper their expectations, leading to potential price adjustments.

For example, Cisco Systems' share price surged in the late 1990s as the internet gained mainstream attention, similar to NVIDIA's recent rise with AI. However, NVIDIA's growth makes Cisco's past gains look modest by comparison. Specific AI use cases and companies focused on niche segments are just beginning to emerge, indicating that AI is still in the early stages of its development. The full maturation of AI technology (Phase 4) is still a long way off.

Investing in AI: Opportunities and Cautions

AI continues to present one of the best long-term investment opportunities. However, the fate of early beneficiaries like NVIDIA remains uncertain. Cisco Systems, for instance, never regained its early 2000 high after the dot-com crash, despite being a major internet player. Sun Microsystems, another early internet darling, ultimately failed as a company.

There is a possibility of an AI crash, and investors should plan for this by realizing profits during market peaks and seeking opportunities in companies that innovate to serve specific industries with AI technologies. Additionally, businesses improving the infrastructure and supply chains necessary for AI's widespread adoption may offer compelling investment opportunities as the technology matures.

We are living in exciting times, just beginning to explore how AI will transform our lives. From an investment perspective, there are numerous opportunities. However, investors should use market history as a guide to set realistic expectations and identify the best opportunities within the AI innovation cycle. By understanding the phases of technological transformation, investors can better navigate the evolving landscape and make informed decisions.

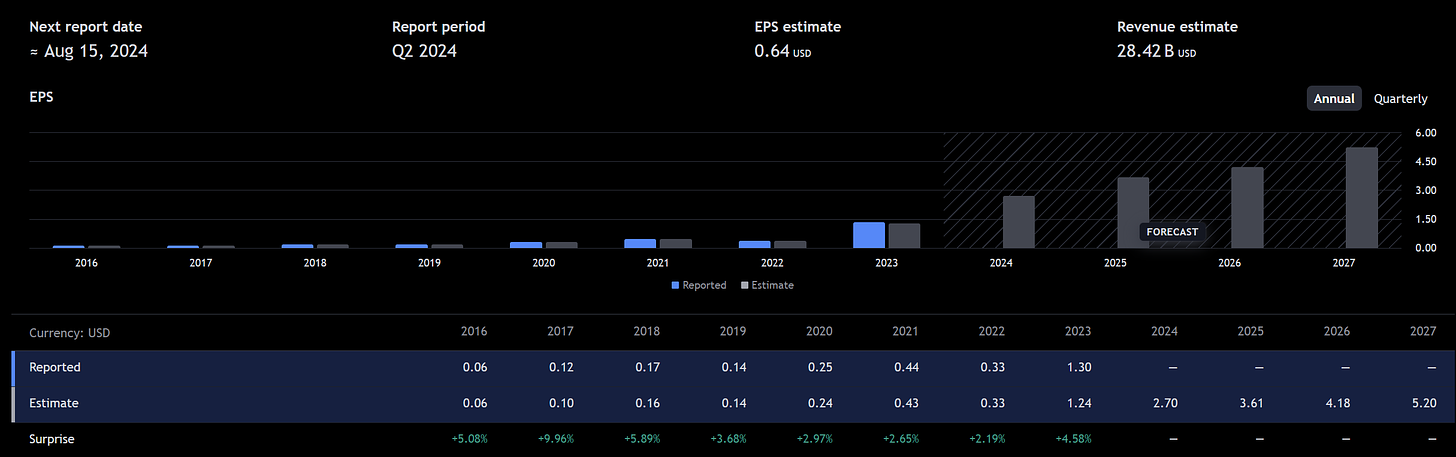

See image below for Annual revenue forecasts.

*Disclaimer: Not Financial Advice. Investors should conduct thorough research and seek professional advice before making any investment decisions.